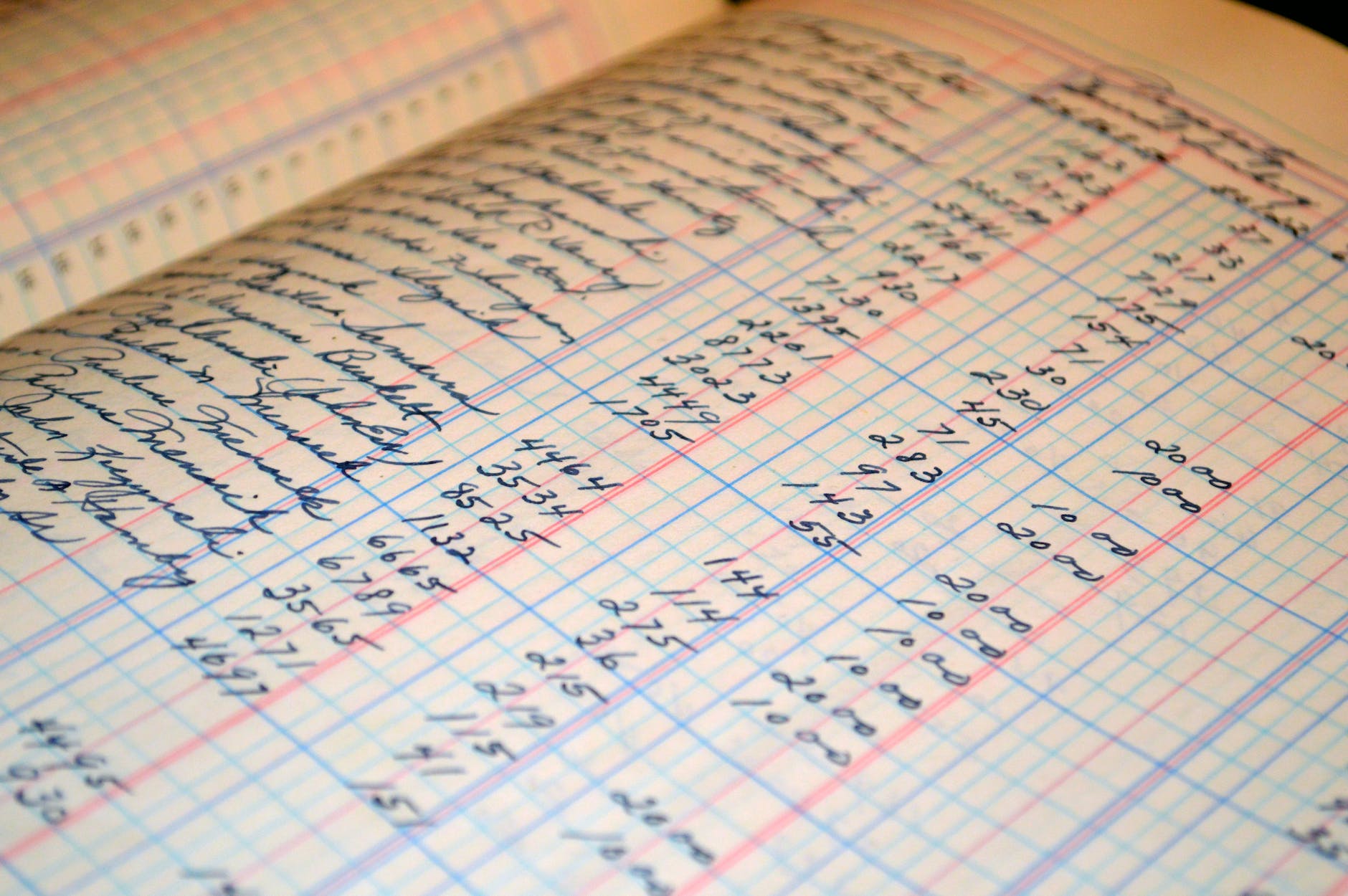

Demystifying the Basics of Understanding Financial Statements

Financial statements are the lifeblood of any business, offering a window into its financial health and performance. Whether you’re an aspiring entrepreneur, a seasoned investor, or a curious individual looking to enhance your financial literacy, grasping the essentials of financial statements is a crucial skill. In this comprehensive guide, we’ll dive into the world of financial statements, breaking down the key components, terminology, and insights they offer. By the end of this article, you’ll have a solid foundation for unraveling the mysteries of financial statements and making informed decisions.

Decoding Financial Statements: An Introduction

Financial statements are the roadmaps that guide stakeholders through a company’s financial journey. They provide a snapshot of its financial position, performance, and cash flows over a specific period. The three primary types of financial statements are the Balance Sheet, the Profit and Loss Account, and the Cash Flow Statement.

1. The Balance Sheet: Unveiling a Company’s Financial Position

Imagine the Balance Sheet as a snapshot of a company’s financial standing at a specific moment, like a freeze-frame of its financial status. It consists of three main components: assets, liabilities, and equity.

- Assets: These represent what the company owns, including tangible items like buildings and machinery, as well as intangibles like patents and trademarks. Assets can be classified as current (expected to be converted into cash within a year) or non-current (held for longer periods).

- Liabilities: These are the company’s obligations, such as debts, loans, and accounts payable. They reflect what the company owes to external parties. Like assets, liabilities are categorized as current (to be settled within a year) or non-current (long-term obligations).

- Equity: Equity is the residual interest in the assets of the company after deducting liabilities. It’s essentially the owner’s claim to the company’s assets. Equity includes common and preferred shares, retained earnings, and additional paid-in capital.

2. The Profit and Loss Account: Unraveling Financial Performance

The Profit and Loss Account provides insights into a company’s profitability during a specific period. It’s like a dynamic snapshot of a company’s earnings performance. Key elements of the Profit and Loss Account include:

- Revenue: The total amount of money generated from the sale of goods or services. Revenue is the starting point of the profit and loss account and is often referred to as the “top line.”

- Expenses: These are the costs incurred to generate revenue. They can include raw materials, employee salaries, marketing expenses, and more. Expenses are subtracted from revenue to calculate profit.

- Gross Profit: Calculated by subtracting the cost of goods sold (COGS) from revenue, gross profit indicates the profitability from core business activities. It showcases the efficiency of production and pricing strategies.

- Operating Income: Operating income is the result of subtracting operating expenses (like salaries, rent, and utilities) from gross profit. It reflects how well the company manages its day-to-day operations.

- Net Income: Also known as the bottom line, net income is what remains after all expenses, including taxes, are subtracted from revenue. It’s a key indicator of a company’s overall profitability and is often used for performance comparisons.

3. The Cash Flow Statement: Navigating the Flow of Funds

The Cash Flow Statement highlights how cash and cash equivalents move in and out of a company. This statement is crucial because it shows the actual cash generated and used by the business, which might differ from reported profits due to non-cash transactions. The Cash Flow Statement consists of three categories:

- Operating Activities: These encompass the primary revenue-generating activities of the business, like sales and payments to suppliers. Operating cash flows indicate the company’s ability to generate cash from its core operations.

- Investing Activities: Investing activities reflect the acquisition and disposal of long-term assets, such as equipment, property, and investments. Cash flows from investing activities provide insights into the company’s capital expenditures and strategic decisions.

- Financing Activities: This category includes activities related to raising capital and repaying debt. Examples include issuing stocks, borrowing money, and paying dividends. Financing cash flows shed light on the company’s capital structure and financing choices.

Mastering Financial Ratios: Unveiling Insights

Beyond the individual financial statements, financial ratios provide deeper insights into a company’s performance and financial health. These ratios allow for comparison with industry standards, historical performance, and even competitors. Let’s explore some key financial ratios:

1. Liquidity Ratios: Assessing Short-Term Viability

Liquidity ratios measure a company’s ability to meet short-term financial obligations and maintain smooth operations. They assess whether the company has enough liquid assets to cover its short-term liabilities.

- Current Ratio: Calculated by dividing current assets by current liabilities, the current ratio indicates a company’s ability to cover short-term obligations. A ratio above 1 suggests good short-term liquidity, indicating the company can pay off its immediate debts.

- Quick Ratio: Also known as the acid-test ratio, this ratio excludes inventory from current assets to provide a stricter measure of short-term liquidity. It indicates whether a company can meet its short-term liabilities without relying on selling inventory.

2. Profitability Ratios: Evaluating Earnings Performance

Profitability ratios focus on a company’s ability to generate profit relative to its revenue, assets, and equity. These ratios help assess how effectively a company manages its operations and controls costs.

- Gross Margin Ratio: This ratio reveals the proportion of revenue that covers the cost of goods sold. It’s an essential indicator of how efficiently a company produces its goods and services. A higher gross margin indicates better profitability.

- Net Profit Margin Ratio: Net profit margin measures the percentage of revenue that translates into net income after all expenses. It showcases the company’s ability to control costs and generate profit. A higher net profit margin is generally favorable.

- Return on Assets (ROA): ROA indicates how efficiently a company utilizes its assets to generate profit. It’s calculated by dividing net income by total assets. A higher ROA suggests effective asset utilization.

- Return on Equity (ROE): ROE measures the return generated for shareholders based on their equity investment. It’s calculated by dividing net income by shareholders’ equity. A higher ROE signifies better returns for shareholders.

3. Solvency Ratios: Gauging Long-Term Stability

Solvency ratios assess a company’s ability to meet its long-term obligations and sustain its operations over the long haul. They provide insights into the company’s financial structure and leverage.

- Debt-to-Equity Ratio: This ratio compares a company’s total debt to its shareholders’ equity, showing the proportion of financing that comes from debt. It’s a measure of financial leverage. A higher debt-to-equity ratio indicates higher financial risk.

- Interest Coverage Ratio: The interest coverage ratio assesses a company’s ability to meet interest payments on its debt. It’s calculated by dividing earnings before interest and taxes (EBIT) by interest expenses. A higher ratio indicates better debt-servicing capacity.

Navigating Footnotes and Disclosures: Going Beyond the Numbers

While the financial statements themselves offer valuable insights, they might not capture the full story. This is where footnotes and disclosures come into play. These supplementary notes provide additional context and information that help readers interpret the financial statements accurately.

Footnotes can include details about accounting policies, contingent liabilities, pending lawsuits, and other crucial information. For example, if a company is facing potential litigation that could result in substantial financial losses, this information might be disclosed in the footnotes. Similarly, footnotes can explain changes in accounting methods or significant events that impact financial performance.

The Role of Financial Statements in Decision-Making

Financial statements are not just for the eyes of accountants and analysts. They play a pivotal role in various aspects of decision-making:

- Investment Decisions: Investors analyze financial statements to assess a company’s potential for growth, profitability, and risks. This information guides their investment choices, helping them make informed decisions about buying, holding, or selling stocks or other securities.

- Credit Decisions: Lenders and creditors review financial statements to determine a company’s creditworthiness and whether they can repay loans. By analyzing the company’s financial position, cash flows, and historical performance, creditors assess the risk associated with lending money.

- Operational Decisions: Company management uses financial statements to make operational decisions, such as resource allocation, cost management, and expansion strategies. By evaluating financial performance, management can identify areas of improvement, allocate resources efficiently, and plan for growth.

Strengthening Your Financial Literacy: Tips and Resources

Enhancing your understanding of financial statements takes time and practice, but it’s an investment that pays off. Here are some tips to help you along the way:

- Start with the Basics: Familiarize yourself with the fundamental concepts of accounting, such as debits, credits, and the accounting equation. Understanding these foundational principles will make comprehending financial statements easier.

- Practice Reading Statements: Find real financial statements of companies you’re interested in and practice analyzing them. Look for trends, anomalies, and changes over time. This hands-on approach will help you develop your analytical skills.

- Take Online Courses: Many platforms offer free or paid courses on financial statement analysis. These courses can provide structured learning and practical insights into interpreting financial statements, calculating ratios, and making informed decisions.

- Read Books and Guides: There are numerous books and guides available that break down financial statements and analysis in an easy-to-understand manner. These resources often provide real-world examples and case studies to illustrate concepts.

- Engage with Financial Experts: Join online communities, forums, or networking events where you can discuss financial statements with experts and enthusiasts. Learning from others’ experiences and perspectives can broaden your understanding.

- Use Financial Software: Utilize financial software or tools that can help automate the process of analyzing financial statements and calculating ratios. These tools can save time and reduce errors in your analysis.

In Conclusion

Understanding financial statements is a critical skill for anyone venturing into the world of business and finance. These documents hold the key to deciphering a company’s financial health, performance, and potential. By unraveling the intricacies of balance sheets, profit and loss accounts, cash flow statements, and the associated ratios, you can make more informed decisions as an investor, entrepreneur, or individual. So, embark on this journey of financial literacy, armed with the knowledge gained from this guide, and watch your confidence in deciphering financial statements soar.