A balance sheet is a financial statement that summarizes a company’s assets, liabilities, and equity at a particular point in time. It provides an overview of the company’s financial position and is an essential tool for investors, creditors, and management. The balance sheet is divided into two sections: assets and liabilities.

Assets include everything that the company owns, such as cash, investments, inventory, property, and equipment. Liabilities, on the other hand, include everything the company owes, such as loans, accounts payable, and taxes. The difference between assets and liabilities is known as equity, which represents the value of the company that is owned by shareholders.

Balance sheets are important for several reasons. First, they provide a snapshot of a company’s financial position, which is useful for evaluating its creditworthiness and financial health. Second, they can be used to identify trends and changes in a company’s financial performance over time. Finally, they are an important tool for management, as they can be used to identify areas where the company can improve its financial performance.

Interpreting balance sheets requires an understanding of the accounting principles used to prepare them. One of the most important principles is the concept of double-entry bookkeeping, which requires that every transaction be recorded in at least two accounts. For example, if a company borrows money, it must record the increase in cash (an asset) and the increase in liabilities (the loan).

Another important concept is the difference between current and non-current assets and liabilities. Current assets are those that can be converted into cash within a year, while non-current assets are those that will provide value over a longer period. Current liabilities are those that are due within a year, while non-current liabilities are those that will require payment over a longer period.

Balance sheets are an essential financial statement that provides a snapshot of a company’s financial position. They are used by investors, creditors, and management to evaluate a company’s creditworthiness, financial health, and performance over time. Interpreting balance sheets requires an understanding of accounting principles such as double-entry bookkeeping and the difference between current and non-current assets and liabilities. By using balance sheets effectively, investors, creditors, and management can make informed decisions about a company’s financial position and potential for growth.

What is included on a balance sheet?

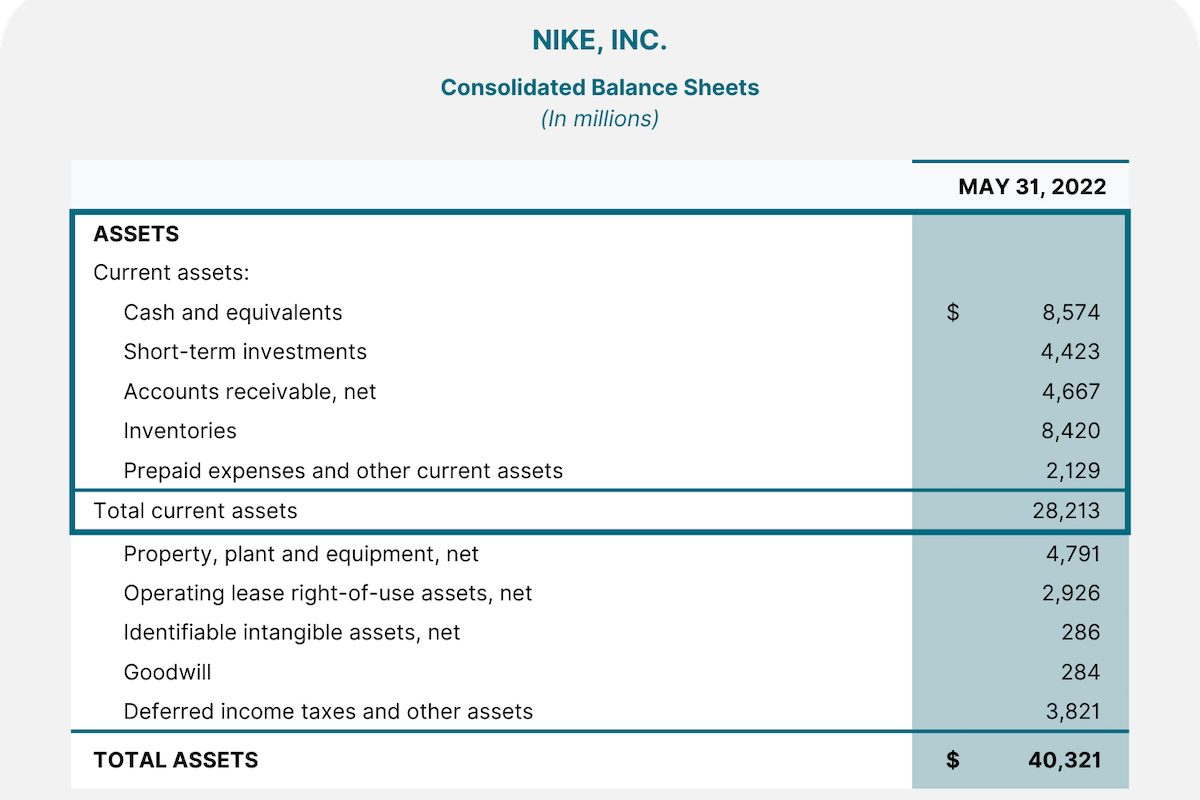

A balance sheet is a financial statement that summarizes a company’s financial position at a specific point in time. It includes three major components: assets, liabilities, and equity.

Assets represent everything that the company owns or controls and can be used to generate future economic benefits. Examples of assets include cash, investments, inventory, property, and equipment.

Liabilities, on the other hand, represent everything the company owes to other parties, including loans, accounts payable, and taxes.

Equity represents the residual interest in the company’s assets after liabilities are deducted. It includes the contributions made by the owners and the profits earned by the company.

The balance sheet follows the accounting equation: Assets = Liabilities + Equity. This equation must always balance, which means that the total value of the assets must always equal the sum of the liabilities and equity.

Assets

Assets are resources that a company owns or controls and that have the potential to generate future economic benefits. They are classified into different categories, including current assets and non-current assets.

Current assets are those that can be converted into cash within a year or a normal operating cycle, whichever is longer. Examples of current assets include cash and cash equivalents, accounts receivable, inventory, and prepaid expenses.

Non-current assets are those that are expected to provide economic benefits for more than one year. Examples of non-current assets include property, plant, and equipment, intangible assets, investments, and long-term receivables.

Assets are important because they help a company generate revenue and profits. For example, a company’s inventory is an asset that can be sold to generate revenue, and its property, plant, and equipment can be used to produce goods and services.

When analyzing a company’s balance sheet, it is important to understand the composition of its assets and how they are valued. The valuation of assets can have a significant impact on a company’s financial performance and overall financial health.

Liabilities

Liabilities are obligations that a company owes to other parties, including suppliers, lenders, employees, and governments. They are classified into different categories, including current liabilities and non-current liabilities.

Current liabilities are obligations that are due within one year or a normal operating cycle, whichever is longer. Examples of current liabilities include accounts payable, short-term loans, and accrued expenses.

Non-current liabilities are obligations that are not due within one year or a normal operating cycle. Examples of non-current liabilities include long-term loans, bonds payable, and lease liabilities.

Liabilities are important because they represent a company’s debt and financial obligations. They can have a significant impact on a company’s financial health and ability to generate profits. For example, if a company has a large amount of debt, it may have to spend a significant portion of its profits on interest payments, which can limit its ability to invest in growth opportunities.

When analyzing a company’s balance sheet, it is important to understand the composition of its liabilities and how they are structured. The structure of a company’s liabilities can have a significant impact on its ability to manage its debt and financial obligations.

How to analyse a balance sheet

Analyzing a balance sheet can provide valuable insights into a company’s financial health and performance. Here are some steps you can take to analyze a balance sheet:

- Check the Balance Sheet Equation: The first step is to ensure that the balance sheet equation balances. This means that the total value of assets should equal the sum of liabilities and equity. If the equation doesn’t balance, there may be errors in the balance sheet.

- Review the Composition of Assets and Liabilities: Look at the categories of assets and liabilities to understand the company’s financial position. Pay attention to the breakdown between current and non-current assets and liabilities, as well as the composition of assets and liabilities within each category.

- Evaluate Liquidity: Review the company’s liquidity position by examining the current assets and current liabilities. This will provide insight into the company’s ability to meet short-term obligations. The current ratio, which is calculated by dividing current assets by current liabilities, can be used as a quick measure of liquidity.

- Analyze Debt: Assess the company’s debt levels by looking at the long-term liabilities and total liabilities. This will provide insight into the company’s leverage and ability to manage debt. The debt-to-equity ratio, which is calculated by dividing total liabilities by total equity, can be used as a measure of the company’s debt levels.

- Examine Asset Efficiency: Review the efficiency of the company’s assets by examining the relationship between the assets and revenue or profits. The asset turnover ratio, which is calculated by dividing revenue by total assets, can be used as a measure of the company’s asset efficiency.

- Assess Equity: Evaluate the company’s equity position by examining the total equity and the breakdown between retained earnings and other components of equity. This will provide insight into the company’s financial health and ability to fund growth opportunities.

What are balance sheets used for?

Balance sheets are an essential financial statement that provides a snapshot of a company’s financial position at a specific point in time. They are used for several purposes, including:

- Evaluating Creditworthiness: Lenders and creditors use balance sheets to evaluate a company’s creditworthiness and ability to repay debts. By examining the composition of assets and liabilities, creditors can assess the company’s ability to generate cash flow and manage debt.

- Assessing Financial Health: Investors use balance sheets to assess a company’s financial health and potential for growth. By examining the composition of assets and liabilities, investors can evaluate the company’s financial position and its ability to generate profits over time.

- Identifying Trends: Balance sheets can be used to identify trends and changes in a company’s financial performance over time. By comparing balance sheets from different periods, investors can identify areas of improvement or potential risks.

- Making Investment Decisions: Balance sheets are an essential tool for making investment decisions. By analyzing the composition of assets and liabilities, investors can determine whether a company is a good investment opportunity and how much to invest.

- Supporting Financial Planning: Management uses balance sheets to support financial planning and decision-making. By examining the composition of assets and liabilities, management can identify areas where the company can improve its financial performance and allocate resources more effectively.

Are Balance sheets relevant for small businesses?

Yes, balance sheets are relevant for small businesses. Although small businesses may have simpler financial statements compared to larger businesses, a balance sheet provides essential information about a company’s financial position at a specific point in time.

Small businesses can use balance sheets to track their assets, liabilities, and equity, which are critical components of their financial position. By monitoring their financial position through a balance sheet, small businesses can make informed decisions about managing cash flow, borrowing funds, and investing in growth opportunities.

Furthermore, balance sheets are useful for small businesses that are looking to obtain financing or credit from lenders. Lenders often require balance sheets as part of their evaluation process to determine a small business’s creditworthiness and ability to repay loans.

Balance sheets can also be useful for small businesses that are looking to sell their business or attract investors. Potential buyers or investors will want to review the company’s financial statements, including the balance sheet, to assess the company’s financial health and potential for growth.

Overall, balance sheets are a relevant and essential financial statement for small businesses. By using balance sheets to monitor their financial position and make informed decisions, small businesses can set themselves up for long-term success and growth.