Discover whether managing your small business finances yourself is a wise decision or if hiring an accountant is a game-changer.

Introduction

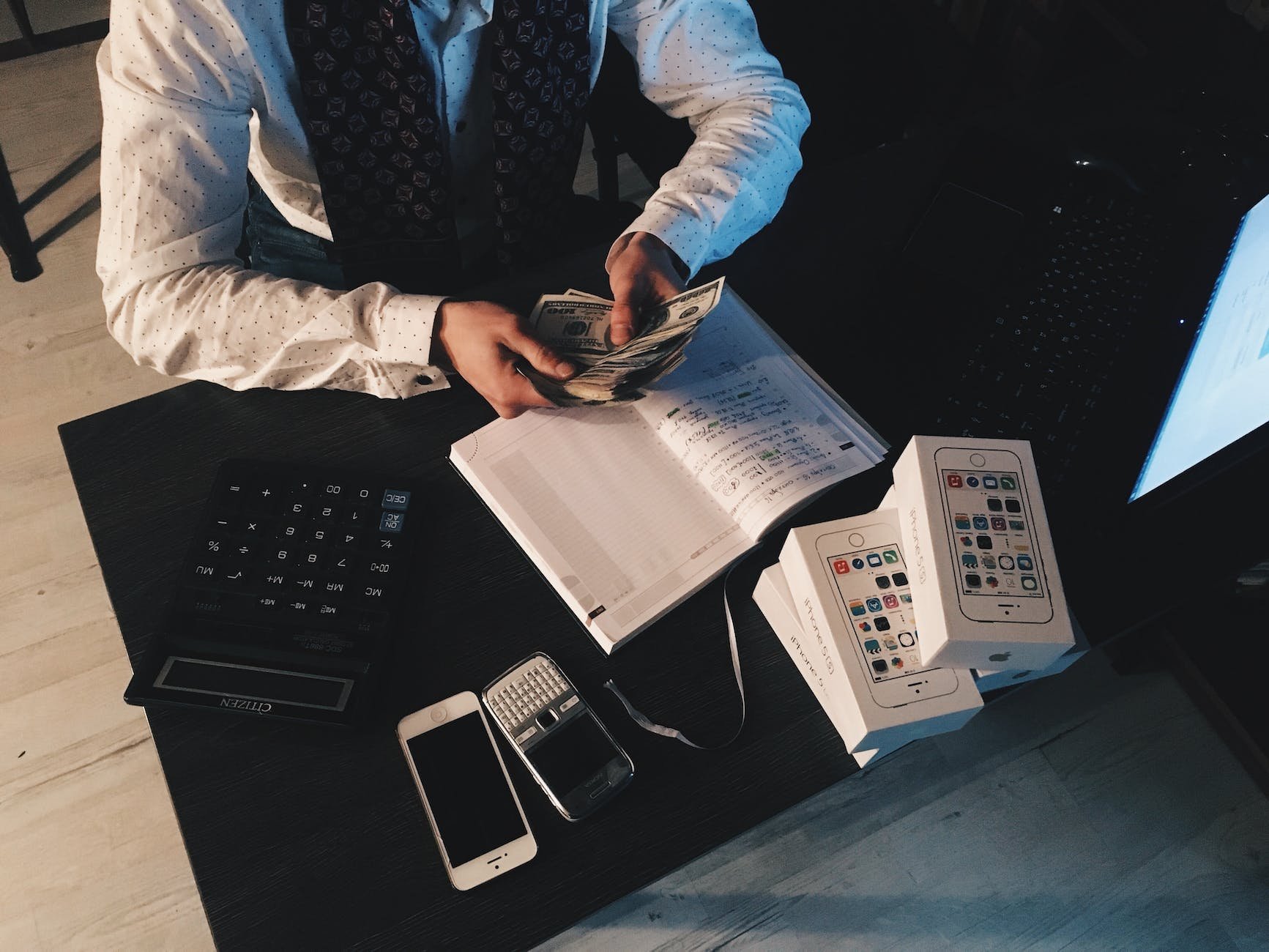

Running a small business is a thrilling endeavor, filled with opportunities and challenges. As a small business owner, you wear multiple hats – from the visionary leader to the hands-on problem solver. One significant question you’ll encounter on your journey is whether to handle your business’s financial matters independently or hire a professional accountant. While each path has its merits, making the right decision hinges on a thorough understanding of your business’s financial needs, your expertise, and your willingness to learn. In this article, we delve deep into the pros and cons of both approaches to help you decide which is best suited for your unique situation.

The Small Business Landscape

Before we plunge into the heart of the matter, let’s acknowledge the dynamic landscape that small businesses navigate. From startup costs and daily expenses to revenue tracking and tax obligations, managing finances is a core responsibility. Small business owners often find themselves grappling with limited resources, time constraints, and the constant juggling act of operational tasks. In this context, the question of whether to hire an accountant or go solo becomes a pivotal decision that can impact both short-term survival and long-term growth.

The Case for Self-Management

The Learning Curve

Many small business owners are drawn to the challenge of managing their finances themselves. They believe that understanding their business’s financial intricacies firsthand can provide invaluable insights. And they’re not wrong. Learning about basic bookkeeping, financial statements, and tax obligations can empower you to make informed decisions and better allocate resources. With a wealth of online resources, courses, and software available, mastering the essentials of business finance is more accessible than ever before.

Cost Savings

When you’re just starting and funds are tight, hiring an accountant might seem like an unnecessary expense. Choosing the DIY route can save you money in the short term. By familiarizing yourself with bookkeeping practices and accounting software, you can maintain accurate records without shelling out for professional services. These cost savings can be channeled into other crucial areas of your business, such as marketing, product development, or expansion.

Hands-On Control

Managing your own finances provides an unmatched level of control. You can immediately address any financial concerns, make real-time adjustments to your budget, and track expenses closely. This level of involvement ensures that you’re intimately aware of your business’s financial health, which can be particularly appealing to those who value autonomy and want to be hands-on in all aspects of their business operations.

Learning and Growth

Taking on the responsibility of managing your business’s finances can be an incredible learning experience. From understanding cash flow patterns to deciphering tax codes, you’ll acquire skills that not only benefit your business but also enhance your personal financial literacy. These skills can prove invaluable even if you decide to hire an accountant later on.

The Advantages of Hiring an Accountant

Expertise and Accuracy

Accountants are trained professionals with a deep understanding of financial regulations, tax codes, and accounting principles. Their expertise can help you avoid costly mistakes, ensure compliance with legal requirements, and provide accurate financial statements that support strategic decision-making. An experienced accountant can identify deductions, credits, and financial opportunities that you might miss on your own.

Time Optimization

As a small business owner, your time is a precious commodity. Spending hours on bookkeeping and financial tasks can divert your focus from core business activities. Hiring an accountant allows you to delegate these responsibilities, freeing up your time to concentrate on growth strategies, customer engagement, and innovation.

Tax Efficiency

Navigating the complex landscape of business taxation requires specialized knowledge. Accountants can help you minimize your tax liability while staying within legal boundaries. They understand tax deductions, credits, and incentives that apply specifically to your industry, ensuring that you don’t leave money on the table during tax season.

Strategic Guidance

Accountants aren’t just number crunchers; they can be valuable strategic partners. With a comprehensive view of your financial landscape, they can provide insights into your business’s profitability, cash flow patterns, and areas for improvement. Their advice can guide your decision-making process and contribute to your business’s long-term success.

The Middle Ground: Hybrid Approach

Rather than an all-or-nothing decision, some small business owners opt for a hybrid approach. They handle basic financial tasks themselves while outsourcing more complex matters to an accountant. This approach allows them to maintain a sense of control over their finances while benefiting from professional expertise in critical areas. For instance, you might handle daily bookkeeping and expense tracking but consult an accountant for tax planning or financial analysis.

Factors to Consider

The decision to manage your small business finances independently or hire an accountant should be based on a careful evaluation of various factors:

Time Availability

Consider the time you can realistically dedicate to financial tasks. If you find yourself overwhelmed by these responsibilities, outsourcing to an accountant might be a sensible option.

Complexity of Finances

If your business involves intricate financial transactions, multiple revenue streams, or complex tax obligations, the expertise of an accountant can help prevent errors and ensure compliance.

Financial Literacy

Assess your comfort level with financial concepts. If you’re unfamiliar with accounting principles and tax regulations, hiring an accountant can provide the guidance you need to navigate these waters effectively.

Long-Term Goals

Think about your business’s growth trajectory. If you’re aiming for rapid expansion, having an accountant on board can streamline financial processes and provide strategic insights that support your goals.

Opportunity Cost

Consider what you could achieve if you weren’t tied up in financial tasks. Could you use that time to develop new products, engage with customers, or explore innovative strategies?

The Decision-Making Process

The journey toward making the right choice for your small business can be likened to solving a puzzle. Assemble the pieces carefully, considering not only the pros and cons but also your business’s specific needs and your personal strengths. Reflect on the balance between the desire for control and the necessity of expertise.

Step 1: Self-Assessment

Begin by assessing your own financial literacy. Be honest about your comfort level with numbers, accounting principles, and tax regulations. Acknowledge both your strengths and areas where you might need guidance.

Step 2: Evaluating Complexity

Analyze the complexity of your business’s finances. If your financial transactions are relatively straightforward, and you feel confident handling them, self-management might be a feasible option. However, if your business involves multiple revenue streams, inventory management, and intricate tax obligations, seeking professional help could prevent costly mistakes.

Step 3: Time Considerations

Evaluate the time you can dedicate to financial tasks. Running a small business demands your attention in various areas, and finding the right balance is essential. If you find that financial tasks are consuming a disproportionate amount of your time, outsourcing to an accountant might be a strategic move.

Step 4: Long-Term Vision

Consider your long-term business goals. Are you aiming for steady growth, rapid expansion, or maintaining a lifestyle business? Your growth trajectory can influence the level of financial expertise you need on your team. Aiming for significant growth might warrant having an accountant to provide strategic guidance and financial planning.

Step 5: Cost-Benefit Analysis

Perform a cost-benefit analysis of hiring an accountant versus managing finances yourself. Factor in the potential cost savings of handling things independently and compare them with the value an accountant can bring to your business. Remember that while accountants come with a cost, their expertise can potentially result in significant financial gains and risk mitigation.

In Conclusion

In the realm of small business management, the decision to manage your finances yourself or hire an accountant isn’t one to be taken lightly. Each approach has its merits, and the right choice hinges on your business’s unique circumstances, your comfort level with financial matters, and your long-term goals. Whether you choose to embark on a journey of financial self-discovery or enlist the expertise of a seasoned professional, the ultimate goal remains the same: ensuring the financial health and success of your small business. As you weigh the pros and cons, remember that flexibility is key. Your decision today doesn’t need to be your decision forever – adapt and evolve as your business grows and your financial needs change.