Setting up a business can be challenging but also very rewarding and Ireland is one of the best places to start a small business in Europe. It is ranked highly for its pro-business environment, highly-skilled workforce, and a low corporate tax rate of 12.5%. This article aims to provide a comprehensive guide to setting up a small business in Ireland.

Legal Requirements

Before starting a business in Ireland, there are certain legal requirements that you need to fulfil. Firstly, you need to register your business with the Companies Registration Office (CRO). The CRO maintains a register of all companies and business names in Ireland. The registration process can be completed online through the CRO website.

Additionally, you will need to obtain a tax number from the Revenue Commissioners. This can also be done online through the Revenue’s website. You will also need to register for VAT if your business turnover exceeds €37,500 per annum.

Business Structures

There are several business structures available in Ireland, including sole trader, partnership, and limited company. Each structure has its advantages and disadvantages, and you should choose the one that best suits your business needs.

Sole trader: A sole trader is an individual who owns and runs the business. This is the simplest business structure, and the sole trader is responsible for all the business’s debts and liabilities.

Partnership: A partnership is similar to a sole trader, but it involves two or more people owning and running the business. Each partner is responsible for the business’s debts and liabilities.

Limited company: A limited company is a separate legal entity from its owners. The company’s shareholders are not personally liable for the company’s debts and liabilities. This is the most complex business structure, and there are additional legal and tax requirements that you will need to fulfil.

Funding and Financing

There are several options available for funding and financing your small business in Ireland. These include:

Bank loans: Banks in Ireland offer a range of loans and credit facilities to small businesses. You will need to provide a business plan and financial projections to secure a loan.

Government grants: The Irish government offers a range of grants and funding programs for small businesses. These include the Enterprise Ireland Competitive Start Fund and the Local Enterprise Office grant.

Venture capital: Venture capital firms invest in early-stage businesses with high growth potential. This type of funding is more difficult to secure, and you will need to have a solid business plan and a strong team.

Taxation

Taxation is an important consideration for small businesses in Ireland. The corporate tax rate in Ireland is 12.5%, which is one of the lowest in Europe. However, there are several other taxes and duties that you will need to pay, including:

Income tax: If you are a sole trader or a partnership, you will need to pay income tax on your business profits. The income tax rate in Ireland is progressive, and it ranges from 20% to 40%.

Value-added tax (VAT): VAT is a tax on goods and services. If your business turnover exceeds €37,500 per annum, you will need to register for VAT and charge it to your customers.

Employer’s PRSI: If you have employees, you will need to pay employer’s PRSI. This is a social insurance contribution that funds social welfare benefits for employees.

Starting a small business in Ireland requires careful planning and consideration. You will need to fulfil certain legal requirements, choose the right business structure, secure funding and financing, and navigate the complex taxation system. However, with the right guidance and support, starting a small business in Ireland can be a rewarding and profitable venture.

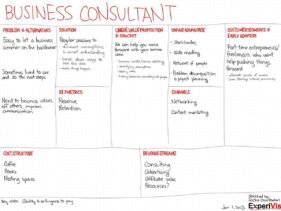

Business plans vs Lean Startup

Business plans and Lean Startup are two different approaches to starting and managing a business. While both aim to help entrepreneurs achieve their goals, they have different focuses and strategies.

A business plan is a comprehensive document that outlines a company’s goals, strategies, market analysis, financial projections, and other important information. It is typically created before the business is launched and serves as a roadmap for the company’s growth and development. Business plans are often used to secure funding from investors or loans from banks, and they are updated periodically to reflect changes in the business.

On the other hand, Lean Startup is a methodology that focuses on creating a product or service that meets the needs of customers in the most efficient and cost-effective way possible. It was developed by Eric Ries and emphasises the importance of experimentation, iteration, and feedback in the product development process. The Lean Startup approach advocates for a “build, measure, learn” cycle, where businesses create a minimum viable product (MVP), measure its performance, and then iterate and improve the product based on customer feedback.

The main difference between business plans and Lean Startup is their focus. Business plans are focused on long-term planning, while Lean Startup is focused on short-term experimentation and learning. Business plans are typically used to secure funding, while Lean Startup is used to develop a product or service that meets the needs of customers.

Both approaches have their strengths and weaknesses, and which one is right for your business depends on your goals and resources. A business plan is more suitable for businesses that require significant upfront investment, such as manufacturing or construction. Lean Startup is more suitable for businesses that require rapid prototyping and testing, such as software development or consumer goods.

In conclusion, both business plans and Lean Startup have their place in the entrepreneurial world. While they may have different focuses and strategies, they both aim to help entrepreneurs achieve their goals and succeed in the marketplace. It’s important for entrepreneurs to consider both approaches and determine which one is right for their business.

The entrepreneur

An entrepreneur is a person who starts and manages a business venture with the aim of making a profit. They are typically innovative and risk-takers, willing to invest their time, money, and effort into a new business idea. Entrepreneurs are often seen as the backbone of the economy, as they create new jobs, drive innovation, and contribute to economic growth.

Entrepreneurship involves identifying a market need or opportunity and creating a product or service that meets that need or opportunity. This requires creativity, vision, and the ability to take calculated risks. Entrepreneurs must be able to develop and implement a business plan, manage resources, and build a team to help bring their vision to life.

There are several traits that are commonly associated with successful entrepreneurs, including:

- Passion: Entrepreneurs are often driven by a deep passion for their business idea and a strong desire to see it succeed.

- Vision: Successful entrepreneurs have a clear vision of what they want to achieve and are able to communicate that vision to others.

- Adaptability: Entrepreneurs must be able to adapt to changing market conditions, customer needs, and technological advances.

- Resilience: Starting a business is not easy, and entrepreneurs must be able to persevere through challenges and setbacks.

- Risk-taking: Entrepreneurs are willing to take calculated risks and invest their time, money, and effort into a new business idea.

Entrepreneurship can be a challenging but rewarding journey. It requires hard work, dedication, and a willingness to learn and adapt. While not everyone is cut out to be an entrepreneur, those who are can make a significant impact on the world around them and create a better future for themselves and others.

What skills do I need to run a startup

Running a startup requires a range of skills, both technical and interpersonal. Here are some essential skills you need to have to run a successful startup:

- Leadership: As a startup founder, you will be responsible for leading your team and making critical decisions that will impact the future of your business. Strong leadership skills are essential to inspire and motivate your team, set a clear vision, and communicate goals effectively.

- Financial Management: A startup’s financial management is critical to its success. You must have a good understanding of finance and accounting to manage cash flow, budget effectively, and make informed decisions based on financial data.

- Marketing: Marketing is essential to the success of a startup, as it helps you to promote your product or service and build your brand. You need to be able to develop marketing strategies, create content, and reach your target audience effectively.

- Technical Skills: Depending on your industry, you may need technical skills such as programming, web design, or data analysis. It is important to understand the technology that underpins your product or service and be able to manage technical resources effectively.

- Problem-Solving: Startups face many challenges, from developing a product to scaling the business. As a startup founder, you need to be able to identify and solve problems quickly and effectively.

- Communication: Communication is key to building relationships with investors, customers, and your team. You need to be able to communicate effectively both verbally and in writing, and listen actively to feedback and concerns.

- Networking: Networking is an essential part of growing a startup, as it helps you to build relationships with potential customers, investors, and partners. You need to be able to identify opportunities and build relationships with key people in your industry.

- Time Management: Running a startup requires a significant time commitment, and you need to be able to manage your time effectively to balance competing priorities and meet deadlines.

Running a startup is a challenging but rewarding journey. By developing these essential skills, you can increase your chances of success and build a thriving business.

The Channels Box: A Crucial Element of the Lean Startup Canvas

The Solution Box: A Critical Component of the Lean Startup Canvas

The Key Metrics Box on the Lean Startup Canvas: What You Need to Know

Lean Startup Canvas: A Comprehensive Guide to Building a Successful Business

Understanding Accounts Payable and Accounts Receivable for Efficient Business Operations

Business Exit Strategy: Essential tips for moving on.

How Irish Local Enterprise Lean for Micro Grants Can Help You Grow Your Business

Boosting Small Businesses with Local Enterprise Business Priming Grants

Boost Your Business with Irish Local Enterprise Business Expansion Grants

Boost Your Business with Irish Local Enterprise Feasibility Study Grants

Irish Local Enterprise Export Assistance Grants: Boosting Export Opportunities for Small Businesses

Local Enterprise Offices in Ireland: Supporting Small Business Growth

Boost Your Business with Irish Local Enterprise Trading Online Vouchers

Lean Startup Trends: How Innovation is Changing Business Forever

The Lean Startup: Revolutionising Business in the 21st Century

A Comprehensive Guide to Incorporating a Business in Ireland

Embracing Artificial Intelligence: The Future of Small Business Marketing:

Agile Development for Small Businesses: A Game-Changer

Balancing Work and Life for Small Business Owners. Is Work/Life balance just for employees?

The Impact of Social Responsibility on Small Business Success

The Benefits of Going Green for Small Businesses

5 Steps to Building a Sustainable Business Model

The Need for Business Insurance for small businesses in ireland

How to Implement a Sustainable Supply Chain for Small Businesses

What is a minimum viable product

Dealing with negative reviews and feedback

Angel Investors: The Key to Funding Small Businesses in Ireland

How do I know if I am a good leader?

How can I get funding for my small business

How can I start a new business in ireland

Lean startup

What is competitive advantage

What are my legal responsibilities as a website owner

You don’t need a CRM! Putting processes ahead of the systems that run them