Break-Even Analysis is a powerful tool that can help businesses of all sizes to assess their financial health and make more informed decisions about pricing, cost control, and profitability. In this chapter, we will explore the concept of Break-Even Analysis in detail, examining its uses, benefits, and limitations, as well as how to calculate and interpret its results.

What is Break-Even Analysis?

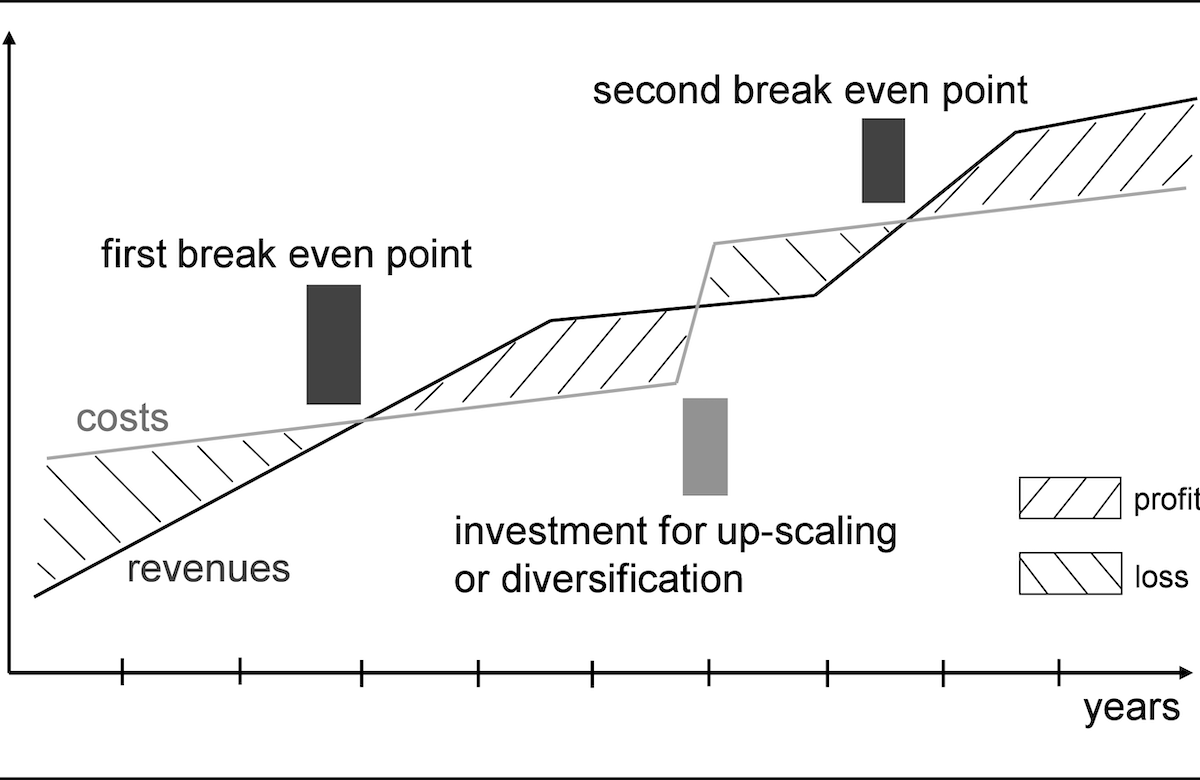

Break-Even Analysis is a financial tool that allows businesses to determine the point at which their total revenue equals their total costs, resulting in zero profit or loss. This point is called the “break-even point,” and it represents the minimum level of sales that a business needs to generate to cover all of its fixed and variable costs.

The Break-Even Analysis takes into account the following factors:

- Fixed Costs: These are expenses that remain constant regardless of the level of sales, such as rent, salaries, insurance, and utilities.

- Variable Costs: These are expenses that vary in proportion to the level of sales, such as raw materials, commissions, and packaging.

- Sales Revenue: This is the total amount of money generated from sales of products or services.

The Break-Even Analysis formula is as follows:

Break-Even Point = Fixed Costs / (Unit Selling Price – Variable Costs per Unit)

The Break-Even Analysis can be conducted for an entire business or for specific products, services, or projects. It is a useful tool for determining the minimum level of sales required to cover costs and make a profit, as well as for evaluating the impact of changes in pricing, costs, or sales volumes.

Uses of Break-Even Analysis

Break-Even Analysis has several uses in business, including:

- Pricing Strategy: By calculating the Break-Even Point, businesses can determine the minimum price they need to charge for their products or services to cover their costs and make a profit. They can also evaluate the impact of price changes on their profitability.

- Cost Control: By analyzing their fixed and variable costs, businesses can identify opportunities to reduce expenses and increase efficiency, without sacrificing quality or customer satisfaction.

- Profitability Analysis: By comparing their actual sales volumes with the Break-Even Point, businesses can assess their profitability and identify areas for improvement. They can also use Break-Even Analysis to evaluate the financial viability of new products, services, or projects.

- Decision-Making: By using Break-Even Analysis, businesses can make more informed decisions about pricing, cost control, investment, and expansion, based on a clear understanding of the financial implications of their choices.

Benefits of Break-Even Analysis

Break-Even Analysis has several benefits for businesses, including:

- Improved Financial Control: By conducting Break-Even Analysis, businesses can gain a better understanding of their financial position and take steps to control costs, increase efficiency, and improve profitability.

- Better Pricing Decisions: By using Break-Even Analysis, businesses can make informed pricing decisions that take into account their costs, competition, and market demand, resulting in more competitive and profitable prices.

- Enhanced Strategic Planning: By incorporating Break-Even Analysis into their strategic planning process, businesses can set realistic goals, evaluate the financial implications of their strategies, and make better-informed decisions.

- Increased Confidence: By having a clear understanding of their financial position, businesses can increase their confidence in their decisions and strategies, leading to greater success and growth.

Limitations of Break-Even Analysis

While Break-Even Analysis is a valuable tool for businesses, it also has some limitations that should be taken into account, including:

- Assumptions and Estimates: Break-Even Analysis relies on certain assumptions and estimates about fixed and variable costs, sales volumes, and pricing. If these assumptions are incorrect or change over time, the Break-Even Analysis results may no longer be accurate.

- Simplistic Model: Break-Even Analysis assumes that all costs and revenues are linear and can be accurately predicted based on sales volumes. However, in reality, costs and revenues may be more complex and may not always follow a linear pattern.

- Limited Scope: Break-Even Analysis only considers the financial aspects of a business and does not take into account other factors that may impact business performance, such as market trends, customer preferences, or technological advances.

- Lack of Flexibility: Break-Even Analysis assumes that fixed costs remain constant regardless of sales volumes, which may not always be the case in practice. For example, if a business needs to invest in new equipment or hire additional staff to increase production, fixed costs may increase.

How to Conduct Break-Even Analysis

To conduct a Break-Even Analysis, follow these steps:

- Identify your Fixed Costs: Make a list of all the expenses that remain constant regardless of sales volumes, such as rent, salaries, insurance, and utilities.

- Determine your Variable Costs per Unit: Identify all the costs that vary in proportion to sales volumes, such as raw materials, commissions, and packaging. Divide the total variable costs by the number of units produced to calculate the variable cost per unit.

- Determine your Unit Selling Price: Determine the price at which you plan to sell your product or service.

- Calculate your Break-Even Point: Use the Break-Even Analysis formula to calculate your Break-Even Point:

Break-Even Point = Fixed Costs / (Unit Selling Price – Variable Costs per Unit)

- Evaluate the Results: Compare your Break-Even Point with your expected sales volumes to determine whether you are likely to make a profit or a loss. You can also evaluate the impact of changes in pricing, costs, or sales volumes on your profitability.

Alternative approaches

While Break-Even Analysis is a useful tool for evaluating the financial health of a business, it is not the only approach that businesses can use to assess their performance and make strategic decisions. Here are some alternative approaches that businesses can consider:

- Profitability Ratios: Profitability ratios measure the relationship between a business’s revenue and expenses, and can provide insights into its profitability and efficiency. Examples of profitability ratios include Gross Profit Margin, Net Profit Margin, and Return on Investment (ROI).

- Cash Flow Analysis: Cash Flow Analysis evaluates a business’s inflows and outflows of cash, and can help identify potential cash flow issues and opportunities for improvement. It can also be used to evaluate the financial viability of specific projects or investments.

- Scenario Analysis: Scenario Analysis involves creating and analyzing different scenarios based on varying assumptions and factors, such as changes in pricing, costs, or sales volumes. It can help businesses evaluate the potential impact of different scenarios on their financial performance and make more informed decisions.

- Value Chain Analysis: Value Chain Analysis involves evaluating all the activities involved in creating and delivering a product or service, and identifying areas for cost reduction and process improvement. It can help businesses optimize their operations and increase profitability.

- SWOT Analysis: SWOT Analysis evaluates a business’s strengths, weaknesses, opportunities, and threats, and can help identify areas for improvement and opportunities for growth. It can be used as a starting point for developing a comprehensive strategic plan.

Ultimately, businesses should choose the approach that best suits their needs and goals, based on their unique circumstances and priorities. By using a combination of different approaches, businesses can gain a more comprehensive understanding of their financial health and make more informed decisions about their future.

Conclusion

Break-Even Analysis is a powerful tool that can help businesses to assess their financial health, make informed decisions about pricing and cost control, and improve profitability. By understanding how to calculate and interpret Break-Even Analysis results, businesses can gain a better understanding of their financial position and make more informed decisions about their future growth and success. However, it is important to be aware of the limitations of Break-Even Analysis and to incorporate it into a broader strategic planning process that takes into account all aspects of business performance.